Does NinjaTrader Have Order Flow?

- Affordable Indicators

Order flow analysis is a particular trading technique designed to assist traders in anticipating, with a high level of confidence, where an imbalance of orders awaits at a future price level. This provides traders with opportunities to enter the market with more certainty and accuracy.

By utilizing order flow analysis, one of the oldest trading techniques used, especially by day traders, you will gain an advantage over other traders in the market.

NinjaTrader’s Order Flow + suite of premium features are available on the NinjaTrader 8 platform. The package of tools helps traders identify buying and selling pressure through visualizing and analyzing trade activity. This premium set of features uses order flow, volumetric bars, and market depth to confirm movement in a specific direction. Here is an individual breakdown of these premium features.

Order Flow Volume Profile Indicator & Drawing Tool

This detailed imagery displayed on the monitor allows traders to evaluate the circulation of trading volume over price for a specific time range to identify critical support and resistance levels. Added features include:

- Select from different display modes.

- Able to chart volume, delta, ticks, or price.

- Value areas and points of control are shown on the monitor.

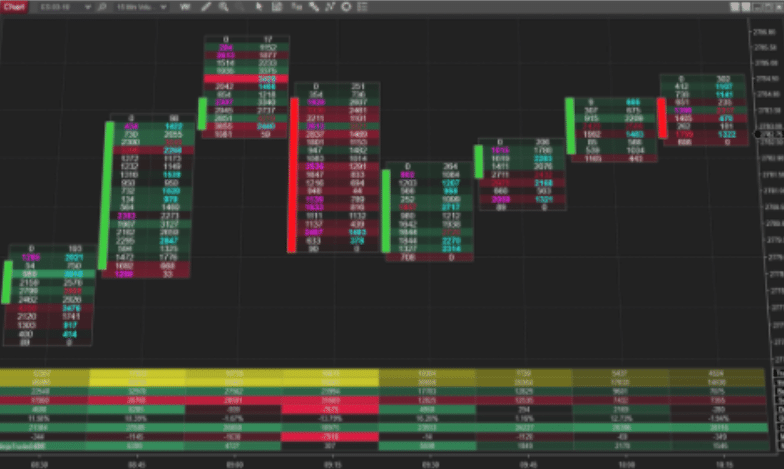

Volumetric Bars

Used to monitor buyers and sellers tick by tick, volumetric bars provide traders with a complete view of the action for order flow trading. Added features include:

- Utilizes a footprint style on-screen representation.

- Ability to see order flow imbalances.

- Volume clusters, absorption, exhaustion, and signs of incomplete auctions are detectible.

Order Flow VWAP

Volume-weighted average price (VWAP) is a moving average that combines volume data. Added features include:

- Uses deviation bands to pinpoint price levels where expected buying and selling levels exist.

- Indicates price breakouts and verifies trends.

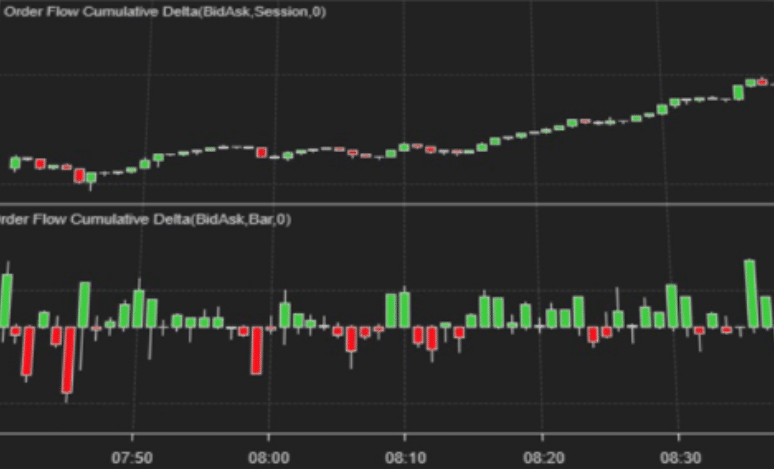

Order Flow Cumulative Delta

Cumulative Delta, which provides evidence of aggressive buying and selling, visually displays the net difference between buyers and sellers at the different price levels. Added features include:

- Verify or reject trends and assess market strength.

- Follow buying vs. selling pressure to detect market reversals.

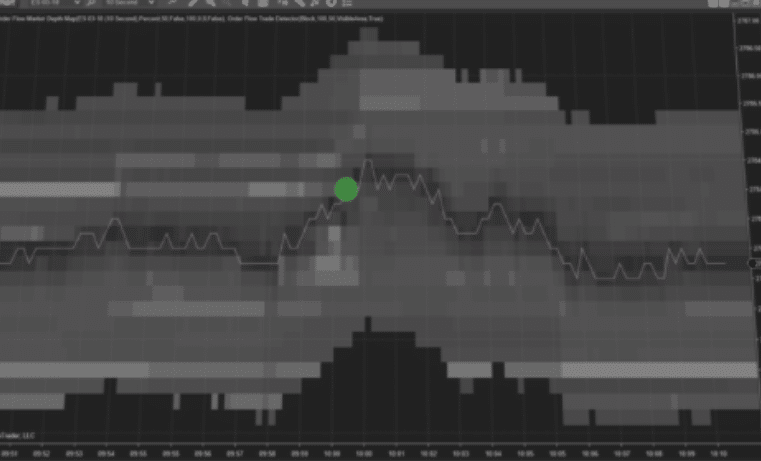

Order Flow Trade Detector

Evaluate the tape and envision significant potential trades on your chart. A potent combo when used together with the Order Flow Depth Map. Added features include:

- Uses buyer or seller activity to keep track of trades.

- The on-screen display depicts trade size or accumulation.

Order Flow Market Depth Map

Monitor and view the limit order book’s past and present activity, providing traders with an in-depth understanding of the market depth and order flow. Added features include:

- Witness the advancement of the limit order book.

- Identify supply and demand with ease.

The indicators and tools reviewed above confirm several available methods to perform order flow trading. Order flow presents crucial information about traders’ orders in the market. This data can reveal the number of contracts traded at the bid or ask, the overall delta, block trades, order imbalances, and more.

Affordable Indicators provides an elite package of indicators for order flow designed for the NinjaTrader 8 platform. Our Impact Order Flow Complete System is a proven order flow solution that will impact your trading results. This system ensures you will never need another NinjaTrader order flow indicator solution.

Most Popular NinjaTrader Articles

Chart Trader

The Enhanced Chart Trader makes it easy to manage trades in a Chart window by solving many common challenges.

Order Flow

The Impact Order Flow analyzes tick data to create a dynamic display of details that truly impact trading decisions.

Indicators

We build the best NinjaTrader indicators with years of experience in trading futures and understanding what traders need.

Contact Our Team

We would love to hear from you! The best way to reach us is using the circular help button in the bottom right corner of this page.

Compare Trade Copier Solutions 🥇

Compare Trade Copier Solutions 🥇