What Is the Best Order Flow Indicator?

- Affordable Indicators

Successful traders all have one thing in common, their ability to use charts to pinpoint the best trade opportunities at any particular time. The ability to recognize patterns that provide insight into where prices may move is invaluable.

Two important characteristics of every chart are price and time. Even though technical indicators that utilize volume are important, they are meant to supplement indicators that focus on price and time. The most successful traders realize that price, time, and volume can be more beneficial when combined than when used individually.

Order Flow Composed of Price, Time, and Volume

Traders who make decisions solely based on price movements within a specific time period do not have a broad enough picture without considering the current volume. Similarly, tracking the volume of the occurring trades gives you no indication of the direction without analyzing price movement in relation to time. And time is only essential when combined with the volume that moves prices. They are all connected.

So, when you combine price, time, and volume, the resulting outcome is a more accurate picture of existing buying and selling pressure on a given asset. This combination is the primary source that drives order flow. Let’s review some specific indicators that make it easier to identify where buying and selling pressure occurs.

VWAP Indicator.

This indicator gives you the impression you’re trading right next to those large financial institutions that manage mutual funds. VWAP stands for Volume Weighted Average Price and is vital to institutional traders as it provides the average price of an asset by including volume and price into the formula. It gives institutions the ability to buy or sell large quantities with high levels of confidence.

Fund managers want to prevent their trades from moving the markets, which can sometimes happen due to the large number of shares they usually buy and sell. The strategy they often use to avoid this is to buy when the ask is less than the average price and to sell when the bid is higher than the average price. Many fund managers rely on the VWAP indicator for this strategy.

Volume Profiles.

People go back to the more famous shopping stores and restaurants for a reason. They know they are safe places to spend their money. This also gives you confidence that it is safe to spend your money at these places as well based on what you’ve heard or experienced. Just the volume of customers you see spending money at these businesses reassures your confidence as a consumer.

When analyzing the price levels of certain assets, the same fundamentals apply. When traders analyze charts, they go through the process of “price exploration” and find certain levels where the price will stabilize. These levels are confirmed by the buying and selling activity taking place.

One of the most effective volume profile indicators on the market is the Order Flow Volume Profile Indicator and Drawing Tool that is part of the Order Flow + suite available for NinjaTrader 8. It analyzes the dispersion of trading volume over price during a specific time range. The well-designed visual display shows the trader’s important support and resistance levels.

Time and Sales Window.

The time and sales window is considered a running record of trades. It displays the size of each trade for a given asset while also providing price details and specific times. It’s the high-tech version of the old ticker tape reading process with more speed and volume capabilities. The benefit it provides is that it allows you to find substantial-sized trades that may reveal significant shifts in buying or selling pressure. Although this is more of a manual process requiring the trader to scan the data visually, traders who master this skill may gain an advantage over other traders.

NinjaTrader’s version of this tool is called Volumetric Bars. It tracks buyers and sellers tick by tick, providing you with a detailed view of the activity for order flow trading. Volumetric bars arm traders with an “x-ray” view into every price bar’s detailed buying and selling activity. Another benefit of this feature is that it presents a tick by tick footprint-style screen image that helps quickly identify order flow imbalance.

Benefits of Using Volumetric Bars.

Volumetric bars determine the difference between buying and selling volumes, referred to as the delta. This information can be used to help make decisions whether buyers or sellers are more aggressive at each price level. This visual depiction can assist the trader when attempting to interpret winners and losers during a specific time period.

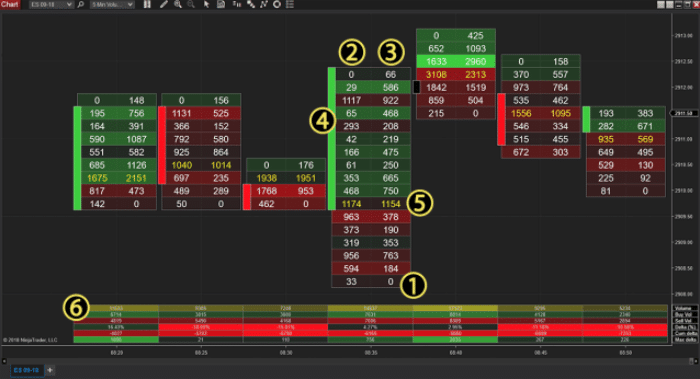

The above chart shows the Volumetric Bar screen applied at 5-minute intervals. Each volumetric bar consists of a candle with two columns to the right. The visual components of volumetric bars include:

- Individual Order Flow + Volumetric Bar

- Sell Volume column – Volume at each price level seen in the bar

- Buy Volume column – Volume at each price level seen in the bar

- Open/Close of the bar

- Highlighted price – Shows the price(s) with the highest volume or delta within the bar

- Bar statistics panel – Shows important values for each Volumetric bar in a static grid-like fashion

Similar to the previously mentioned Time and Sales window, Volumetric Bars are not indicators but can provide valuable insight into order flow.

The visualization of order flow gives traders the ability to pinpoint buying and selling pressure, which allows them to confirm the directional movement of the market as trading unfolds.

The Order Flow Plus Suite of premium features available for NinjaTrader 8 provides tools to analyze trade activity using order flow and volumetric bars.

Affordable Indicators offers an Impact Order Flow system that is unmatched in performance and customizability compared with other NinjaTrader order flow indicator solutions. Our package will exceed your NinjaTrader order flow indicator needs.

Most Popular NinjaTrader Articles

Chart Trader

The Enhanced Chart Trader makes it easy to manage trades in a Chart window by solving many common challenges.

Order Flow

The Impact Order Flow analyzes tick data to create a dynamic display of details that truly impact trading decisions.

Indicators

We build the best NinjaTrader indicators with years of experience in trading futures and understanding what traders need.

Contact Our Team

We would love to hear from you! The best way to reach us is using the circular help button in the bottom right corner of this page.