- Mon - Fri: 8:00 AM – 6:00 PM EST

Summary

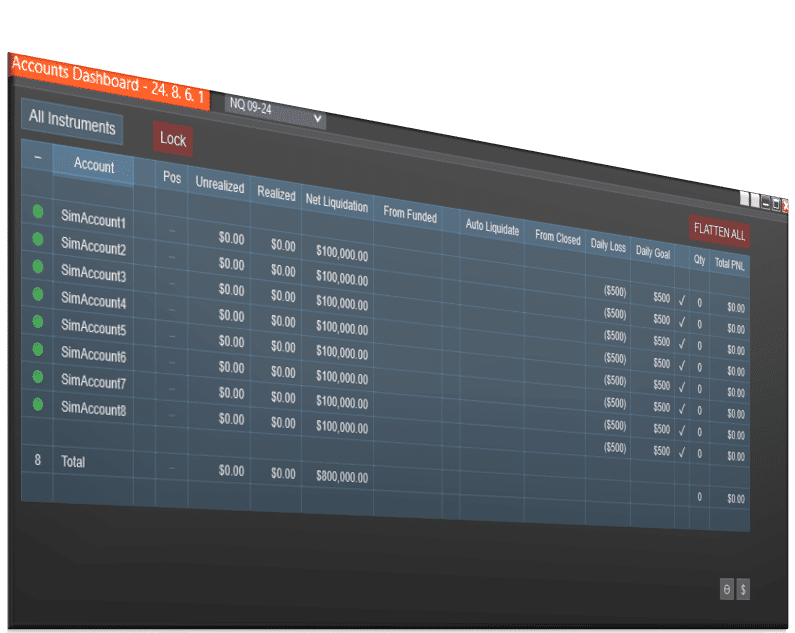

Account Risk Manager is a reliable risk control tool for NinjaTrader Desktop. Built for prop firm, funded, and personal accounts, it enforces daily goals and losses, tracks trailing drawdown/auto-liquidate levels, adds exit-order protections, and even includes a one-click “One Trade” helper for firms that require a daily trade.

Trade copier features are sold separately. Save by purchasing the Accounts Dashboard Suite for a complete solution with trade copier and prop firm risk management features. You can also add Duplicate Account Actions trade copier features later.

Watch this video for a quick features overview!

Find more videos in this playlist on the YouTube Channel.

Account Risk Manager Features and Benefits

Evaluation Account Funded Exit – Automatically flatten an evaluation account the moment it reaches the funded goal plus your buffer (set in the “Evaluation Account Goal + ($)” input). The account is unlisted as a follower and the funded button is disabled so you don’t overtrade a passed eval.

From Funded / From Closed Columns –

- From Funded: shows dollars remaining to the funded goal (including your buffer).

- From Closed: shows dollars remaining until the account would be closed by the firm.

This puts crucial thresholds in view at all times.

Auto-Liquidate (Trailing Drawdown) Tracker – Continuously tracks the trailing threshold (e.g., Apex-style peak minus $2,500) and shows real-time distance to breach with color warnings that progress from green → yellow → orange → red.

Daily Goal & Daily Loss – Set per-account daily profit targets and max-loss limits. When reached, Account Risk Manager automatically flattens positions and prevents further risk for the day.

Exit Shield – Protects exits by blocking changes that increase risk or reduce reward. Restrict raising stop losses or lowering profit targets, either relative to the original placement or any move that worsens risk/reward.

One Trade Button – On funded or passed evaluation accounts with zero trades today, click once to submit a micro in/out and satisfy daily trade requirements with minimal exposure.

Multi-Account Ready – Configure unique daily goal/loss values, warning thresholds, and protections per account. Works for funded, evaluation, and personal/cash accounts.

Flexible Setup – Initialize peak values once, then everything auto-tracks and saves going forward. Adjust daily goal/loss amounts, visibility, and column preferences in settings any time.

Prop Firm Coverage – Designed for Apex and continually updated for other funded firms based on customer needs, including:

- APEX Trader Funding

- Blusky Trading

- Bulenox

- Futures Funded Network

- Leeloo Trading

- Legends Trading

- LifeUp Trading

- MyFundedFutures

- Phidias

- Purdia Capital

- Take Profit Trader

- TickTickTrader

- TradeDay

- TradeFundrr

- Tradeify

Account Risk Manager runs on the NinjaTrader Desktop Platform and works with accounts connected to NinjaTrader Desktop (including connections commonly used by prop firms such as Rithmic).

How to Use Account Risk Manager

Account Risk Manager centralizes risk so you can trade multiple accounts with confidence. Common uses include:

- Prop firm compliance – Hit evaluation goals safely, auto-flatten at funded, and always see distance to trailing drawdown.

- Funded accounts – Enforce daily loss and profit targets. Use the One Trade button to satisfy daily activity rules with minimal exposure.

- Personal/cash accounts – Apply the same discipline that keeps prop accounts safe: daily caps, exit protections, and clear risk visibility.

- Multi-account workflows – Configure different daily caps and protections by account and toggle them on/off as you rotate through accounts.

Getting started is straightforward:

- Connect your accounts in NinjaTrader Control Center.

- Open the Accounts Dashboard window and enable Risk.

- Enter funded goals/buffers and initialize peak values (first use only).

- Set per-account daily goal and daily loss; enable Exit Shield if desired.

- Trade knowing positions will auto-flatten at your limits, and your trailing threshold is always visible.

Pro insight: Many traders enable conservative daily loss and a small profit goal at first. This keeps emotions in check while you get familiar with Exit Shield behavior and warning colors.

Related NinjaTrader Indicators and Bundles

Accounts Dashboard Suite – Trade Copier and Risk Manager

Introducing the ultimate account management bundle for NinjaTrader. The Accounts Dashboard Suite combines our premier Duplicate Account Actions trade copier and Account Risk Manager at a discounted price (SAVE $100). Manage both execution syncing and risk in one window.

- Automatic trade copying across multiple accounts.

- Daily goal and daily loss restrictions to manage risk.

- A single Accounts Dashboard window to control both tools together.

- Discounted pricing compared to purchasing separately.

It’s a complete package for traders who want both execution syncing and built-in risk control.

Duplicate Account Actions – NinjaTrader Trade Copier

If you’re looking for the trade copier, purchase Duplicate Account Actions. It keeps positions and orders synchronized across accounts and includes advanced tools like Executions Mode, Orders Mode, ATM assignment, Fade, and rejected-order handling.

Good news: Account Risk Manager and Duplicate Account Actions can work together in the same Accounts Dashboard window or independently. You do not need to own the copier to purchase Account Risk Manager.

Explore our NinjaTrader indicators collection

Download Account Risk Manager

Account Risk Manager gives you firm, real-time guardrails: daily caps, trailing drawdown awareness, exit protections, and one-click compliance helpers.

Download Account Risk Manager today to enforce discipline across every account connected to NinjaTrader Desktop.

Looking for more tools? Explore our full NinjaTrader software library

Account Risk Manager FAQs

How do I install Account Risk Manager?

After purchase, download the file and import it into NinjaTrader Desktop using the import function. Open the Accounts Dashboard, enable Risk, initialize peak/funded values, and set daily goal/loss per account.

Does Account Risk Manager work with prop-firm accounts?

Yes. It’s designed for Apex and updated for many firms. It tracks trailing drawdown/auto-liquidate levels, helps you hit funded goals safely, and can auto-flatten when targets or limits are reached.

What’s the difference between Account Risk Manager and the trade copier?

Account Risk Manager enforces risk: daily goal, daily loss, exit restrictions, funded auto-exit, and drawdown tracking. Duplicate Account Actions copies trades between accounts. Use either alone or both together in the Accounts Dashboard.

Do I need Duplicate Account Actions to use Account Risk Manager?

No. Account Risk Manager runs independently. If you also want a copier, get Duplicate Account Actions or the discounted Accounts Dashboard Suite.

What is Exit Shield?

Exit Shield blocks changes that worsen risk/reward such as raising stop losses or lowering profit targets, helping you maintain discipline during live trading.

Check it out and take the first step towards elevating your ability to trade multiple funded accounts!

Reviews

Customer satisfaction is our highest priority! We use Trustpilot and Google Reviews for the best transparency.

NinjaTrader Trade Copier

Are you searching for the perfect tool to take your trading game to the next level? Look no further than our NinjaTrader Trade Copier product: Duplicate Account Actions. This powerful indicator allows you to seamlessly duplicate account actions from a selected master trading account to an unlimited number of slave accounts. Experience more efficient and effective trading by tracking executions and submitting orders with ease. Say goodbye to the hassle of manual trade copying and hello to a game-changing tool for any serious trader. Upgrade your trading game with Duplicate Account Actions today.

NinjaTrader Platform

New to NinjaTrader? Check out our NinjaTrader page to get started! It is free to download immediately.

Have other questions about NinjaTrader? Check out our FAQ page!

Refund and Sales Policy

All sales are final and non-refundable. If you have any questions please contact us before completing a purchase.

Product licenses can only be used on the purchaser’s computer/computers. Extra product licenses cannot be given away for free or resold. All purchases include a lifetime license with future upgrades for free. Our goal is to continually improve all of our products in performance, compatibility, and new features!

Discord

We’ve created a community platform where users can interact with and help each other succeed in their day trading goals. Join our Discord Channel Today!

Categories: Indicators, Trade Copier

Buy With Confidence

We have a strong foundation with over 12 years of experience serving thousands of NinjaTrader users.

Contact Our Team

We would love to hear from you! The best way to reach us immediately is using the circular help button in the bottom right corner of this page.

Check out other related NinjaTrader indicators and tools...

- Bundles

Support and Resistance Suite

$1,495.00$895.00 40% OFF This product has multiple variants. The options may be chosen on the product page - Bundles

Professional Chart Trader Tools

$3,995.00$2,395.00 40% OFF This product has multiple variants. The options may be chosen on the product page - Enhanced Chart Trader

Essential Chart Trader Tools

$995.00$495.00 50% OFF This product has multiple variants. The options may be chosen on the product page