- 678-551-2107

- Mon - Fri: 8:00 AM – 6:00 PM EST

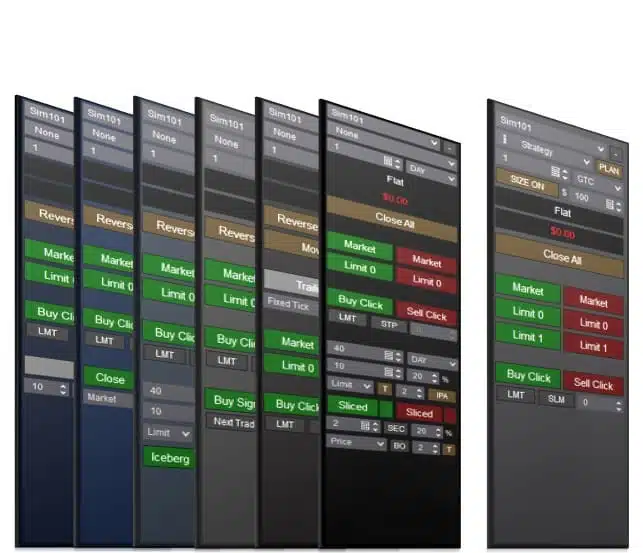

This product includes the Basic Chart Trader Tools that establishes the foundation of our Enhanced Chart Trader products for NinjaTrader. To get started for ONLY $195 check out the Basic Chart Trader Tools product!

This product includes the Basic Chart Trader Tools that establishes the foundation of our Enhanced Chart Trader products for NinjaTrader. To get started for ONLY $195 check out the Basic Chart Trader Tools product!

Summary

An Iceberg order executes a large volume order by breaking it into smaller disclosed orders. The full order quantity is hidden from the market. When an Iceberg order is submitted, disclosed orders are sent automatically. As one disclosed order is filled, the next one is immediately sent, and this process continues until the entire Iceberg order is filled.

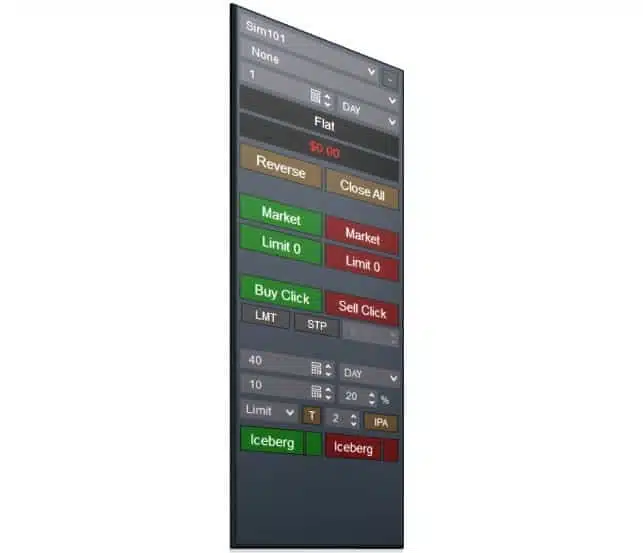

In this screenshot above, we will review a practical application. The Iceberg Entry Orders module is configured to create a position with 40 contracts – orders will be submitted for 5 contracts at a time with a 40% variance (3-7 contracts). The Iceberg Entry Orders module for NinjaTrader is unrivaled in ability to efficiently submit trades with big size. The Iceberg Entry Orders Module can be configured through the settings below.

Features

- Big Quantity – the total amount of contracts for the complete Iceberg order.

- Display Quantity – sets the quantity for disclosed orders that are visible in the market.

- Variance (%) – sets the percentage (0-100) by which to vary the display quantity.

- Display Order Type – set the order type that is visible in the market – Market, Limit, or Stop.

When Display Order Type is set to Limit or Stop, another set of features is introduced:

- Order Offset Trailing – when enabled, Limit or Stop order will trail with the market until filled.

- Order Offset (Ticks) – the number of ticks configured with Order Offset Trailing functionality.

- In Profit Action – how to handle Limit orders that aren’t filled – either cancel or fill at market.

This product includes the Basic Chart Trader Tools that establishes the foundation of our Enhanced Chart Trader products for NinjaTrader. Please check out the Basic Chart Trader Tools page for a detailed overview – it is designed to replace and enhance the standard NinjaTrader Chart Trader.

NinjaTrader Trade Copier

Are you searching for the perfect tool to take your trading game to the next level? Look no further than our NinjaTrader Trade Copier product: Duplicate Account Actions. This powerful indicator allows you to seamlessly duplicate account actions from a selected master trading account to an unlimited number of slave accounts. Experience more efficient and effective trading by tracking executions and submitting orders with ease. Say goodbye to the hassle of manual trade copying and hello to a game-changing tool for any serious trader. Upgrade your trading game with Duplicate Account Actions today.

New to NinjaTrader? Check out our NinjaTrader page for more information on getting started! You can download it completely free! Have a question? Check out our FAQ page!

NinjaTrader Platform

All sales are final and non-refundable. If you have any questions please contact us before completing a purchase. Product licenses can only be used on the purchaser’s computer/computers. Extra product licenses cannot be given away for free or resold. All purchases include a lifetime license with future upgrades for free. Our goal is to continually improve all of our products in performance, compatibility, and new features!

Refund and Sales Policy

Discord

We’ve created a community platform where users can interact with and help each other succeed in their day trading goals. Join our Discord Channel Today!

Category: Enhanced Chart Trader

Tag: Order Execution

Buy With Confidence

We have a strong foundation with over 10 years of experience serving NinjaTrader users.

I’ve used dozens of different indicators over the years and the ones I’ve gotten from Affordable Indicators are by far my favorite. They’re reliable, they are not resource heavy and, when I have a question, the support is responsive and helpful. Highly recommended!

Brent S.

Futures Trader

Contact Our Team

We would love to hear from you! The best way to reach us is using the circular help button in the bottom right corner of this page.

- (678) 551-2107 (Call or Text)